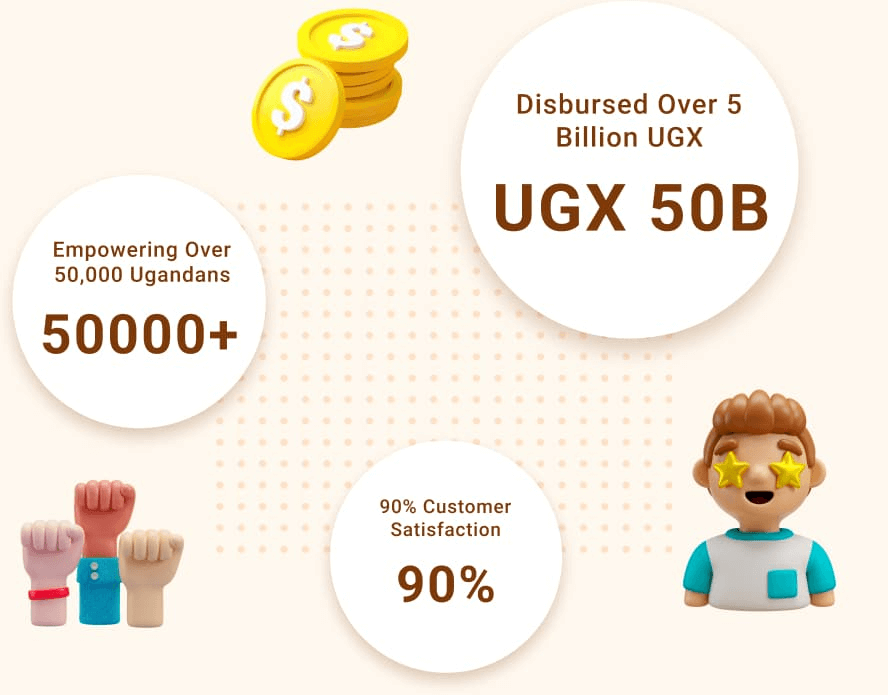

What We Achieved

At KreditSente, we take pride in our impact on the financial well-being of Ugandans. Our mission is to empower individuals by providing accessible and transparent financial solutions. Here’s what we’ve achieved so far:

- We’ve helped over 50,000 people across Uganda achieve their financial goals with quick and easy loans tailored to their needs.

- KreditSente has successfully disbursed loans worth over 5 billion UGX, providing critical support to individuals and businesses alike.

- Our commitment to excellent service is reflected in our 90% customer satisfaction rate. We continuously strive to improve our services to meet your needs.